9 Common Student Loan Mistakes And How to Avoid Them In 2024

When it comes to student loans, there are a lot of traps to avoid, such as not knowing what the best interest rates are or how to make payments. However, with a little understanding, you can steer clear of these blunders and ultimately save a great deal of money and frustration.

What’s the best way to avoid these mistakes?

i. Making and adhering to a budget is the first step.

ii. Make sure you just borrow the amount necessary to cover educational costs including tuition, books, and fees. iii. Additionally, make an effort to restrict your borrowing to federal student loans only, as these loans typically have more flexible repayment options and lower interest rates than private ones.

Common Student Loan Mistakes And How to Avoid Them

- Borrowing Too Much

Borrowing more than you need, or applying for multiple loans with different interest rates and payment terms, can make managing your debt more difficult. The debt burden can be too high, especially if the borrower loses his job or has financial problems.

- Don’t look for the best interest rates

When it comes to student loans, the interest rate you pay can have a big impact on the overall cost of your loan. That’s why it’s important to look around for the best interest rates before deciding on a loan.

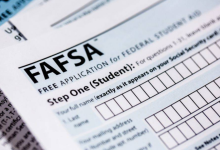

Federal Student Loan interest rates are set by Congress and are the same for all borrowers. But there is a lot of competition among private lenders, so interest rates can vary greatly. The best way to find the lowest interest rate is to get quotes from several different lenders. You can use a tool like Credible to compare rates from multiple lenders in just a few minutes.

Remember that the interest rate is not the only factor to consider when choosing a student loan. You should also see the rates, payment options, and benefits for the borrower. However, getting a lower interest rate will save you money over the life of your loan.

- Underwriting a Loan Without Understanding the Consequences

If you underwrite a loan and the borrower defaults, it could damage your credit rating and your ability to obtain future loans. They can also be responsible for paying back the entire loan if the borrower cannot or does not want to pay.

Before signing any loan, make sure you understand the terms and the risks involved.

- Rely on Student Loans for Living Expenses

Like most college students, you probably rely on student loans to cover your living expenses. This can be an error for several reasons. If you’re not careful, you can borrow more money than you need, increasing your overall debt and making it harder to pay off your loans after graduation.

It can be difficult to rely too heavily on student loans to meet other financial obligations, such as rent, utilities, and groceries. Finally, if you can’t find a job or experience other financial setbacks after graduation, you could default on your student loans, which can have serious consequences.

- Missed Opportunities to Save Money

Student loans can be confusing, and it’s easy to make mistakes when trying to navigate the process yourself.

The first thing you should know is that there are many different types of student loans and each one has different terms and conditions that affect how much interest you have to pay.

For example:

If you have multiple loans, it’s important to know which one has the highest interest rate so you can focus on paying it off first.

If your loan pays 0% interest for the first few years, don’t wait until this period has expired to pay off your debt, but start as soon as possible!

In addition to early repayment, there are also many ways to save money with student loans. You may get a better deal by refinancing or choosing a different payment plan (such as an income-based one).

- Don’t Chase the Best Offer

You should never take the first student loan offer that comes your way. There are many different lenders and they all have different terms and conditions. Therefore, it is important to compare offers before deciding which one is right for you.

- Not Knowing Your Payment Options

Many students apply for federal loans because they don’t know their options. Federal loans come with fixed interest rates and income-based payment plans that can help you pay off debt faster, depending on your circumstances.

If you want to get rid of your student loan quickly, consider a backpay or refinance with a private lender after you graduate and are in full-time employment.

- Not updating your lender contact information

If you don’t update your lender contact information, you may miss important communications related to your loan. This can result in late payments or default on your loan.

To avoid this, be sure to keep your contact information up to date with your lender. You can usually do this online or by calling customer service.

How to avoid these mistakes?

Do not borrow more than you need to. Borrow only the essentials for study and living expenses. Borrowing more money will cost you more in interest and fees.

Make sure you understand the terms of the loan before signing anything. Know the interest rate, repayment schedules, and other important details about your loan so there are no surprises later.

Avoid private borrowing whenever possible. Personal loans tend to have higher interest rates and may not offer the same flexible repayment options as federal loans.

If you have multiple loans, be sure to pay them off. Missed payments can lead to bankruptcy, ruin your credit score, and make it harder to get future credit.

Make sure you keep track of your loan balance and how much you still owe.

That way you can budget accordingly and make sure you don’t owe more than you can afford to pay back.

Conclusion

Having outlined the most common mistakes people make with student loans and how to avoid them. We Hope that you are now well equipped with all the knowledge you will need to handle student loans without making the common mistakes.